02 : Projects

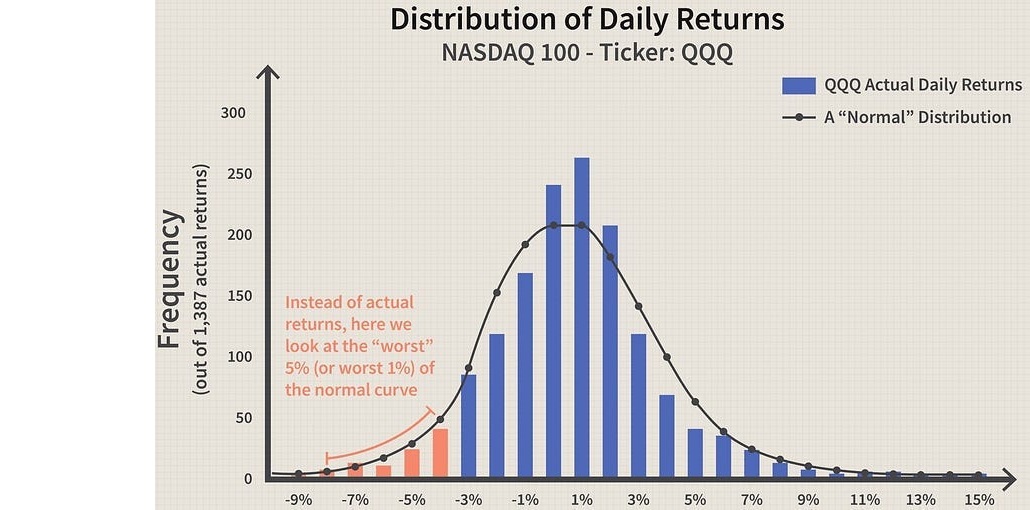

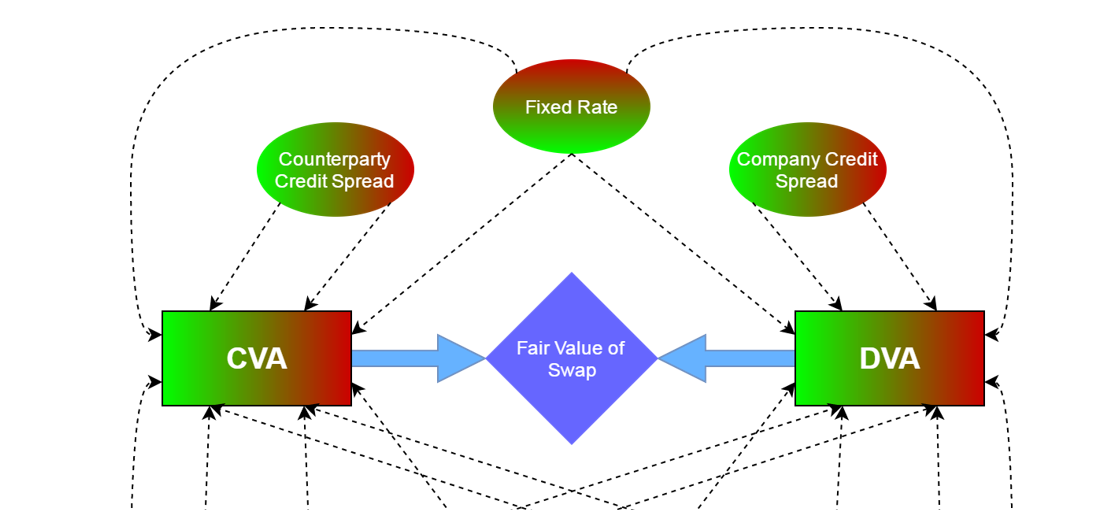

I am passionate about quantitative research and have developed projects that showcase my expertise in data science, financial modeling, and algorithmic trading. One of my notable projects is the "Value-at-Risk (VaR) Estimation Model for Multi-Asset Portfolio," where I implemented Monte Carlo simulations and historical simulations to compute VaR across diverse asset classes. This project enhanced my skills in risk management and financial analytics. Another significant achievement is the "Counterparty Credit Risk Model using CVA & DVA Adjustments," which involved pricing credit and debit valuation adjustments for OTC derivatives using Monte Carlo methods and hazard rate modeling. These projects highlight my proficiency in financial modeling, quantitative analysis, and Python programming.

.jpg)