001 : Real-Time News Sentiment Signal Engine for Trading

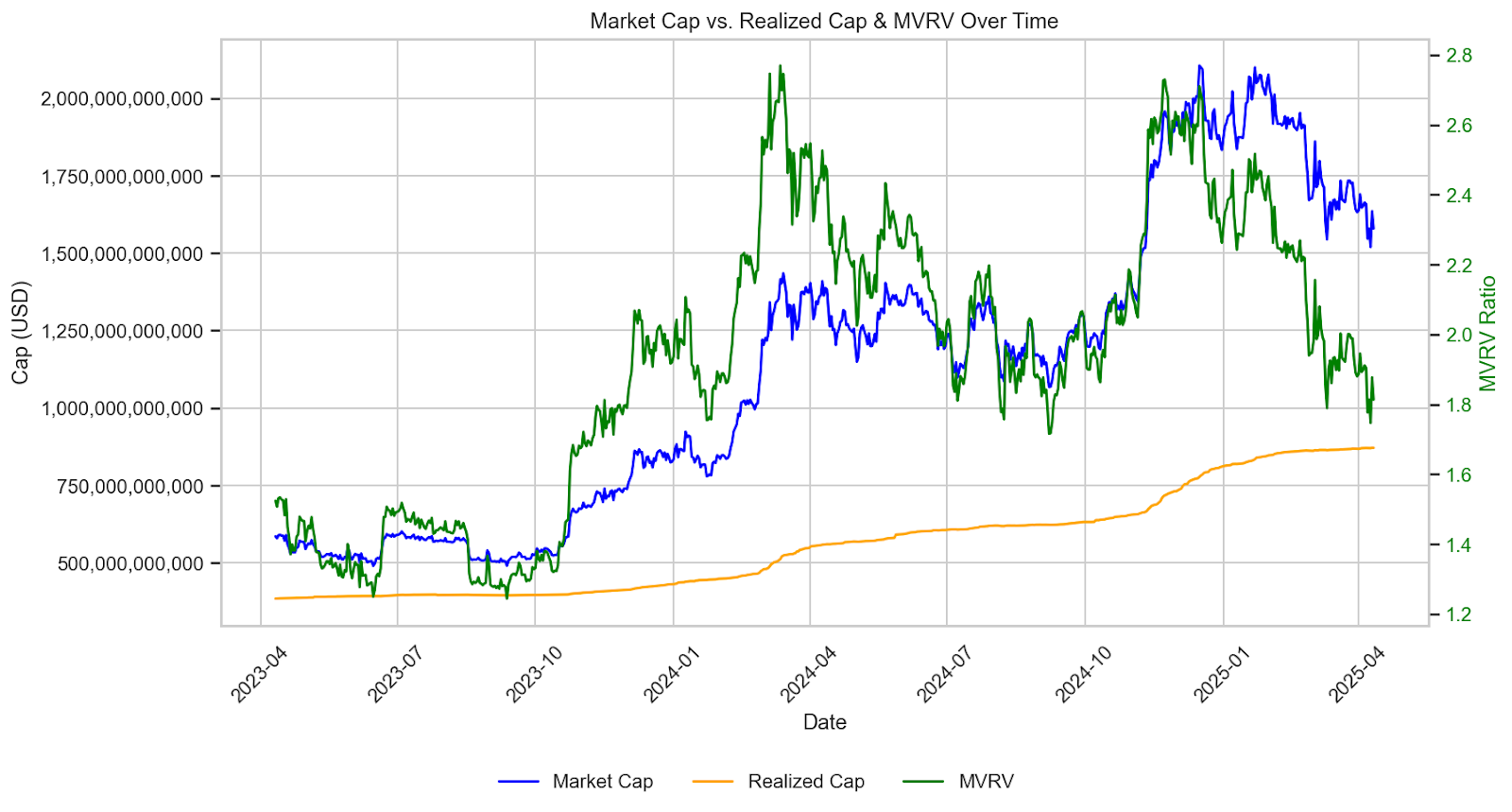

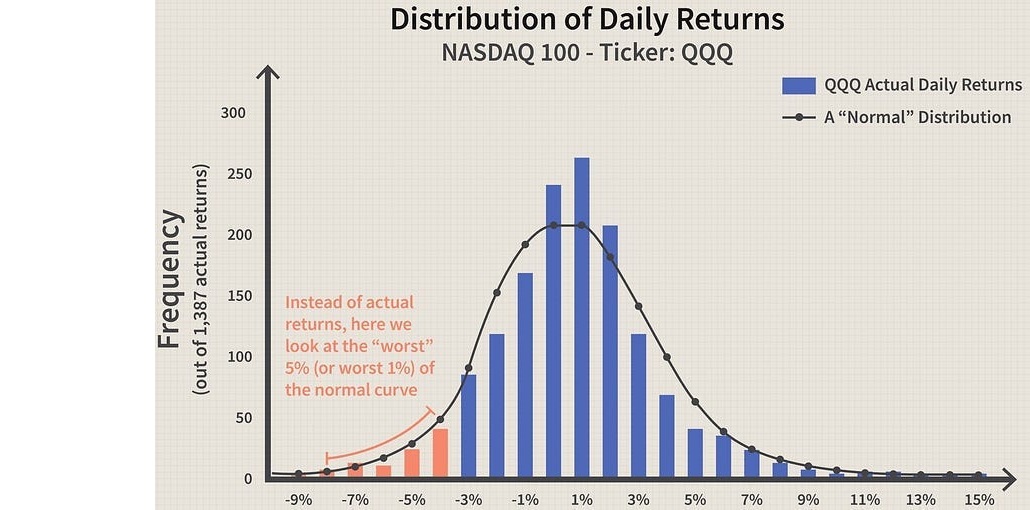

002 : VaR-CVaR Estimation for AI Stocks and Bitcoin Correlated Portfolio

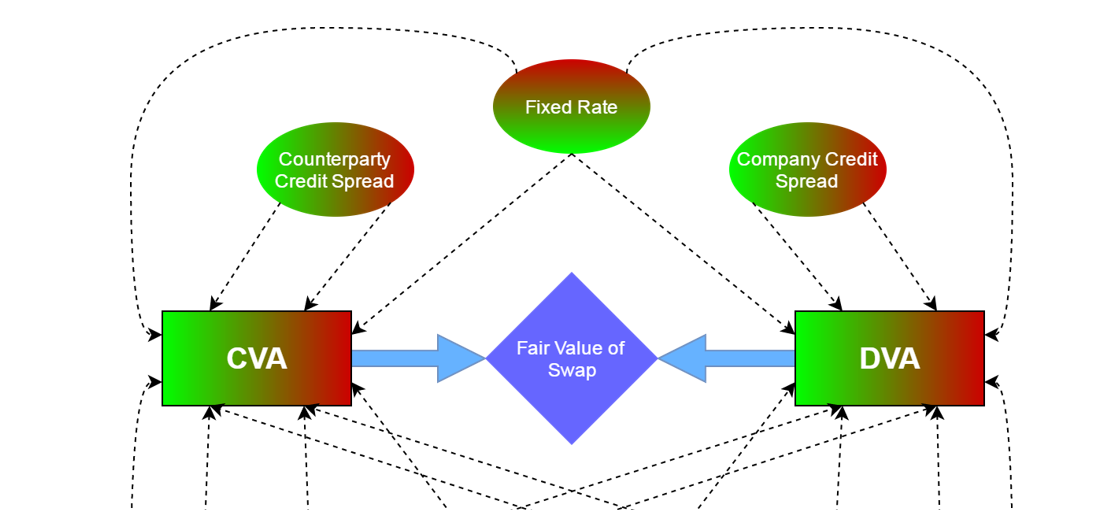

003 : Counterparty Credit Risk Model using CVA and DVA Adjustments

.jpg)

004 :Value-at-Risk (VaR) Estimation Model for Multi-Asset Portfolio